Our Approach to Engagement

Better Businesses, Policy Advocacy, Investor Stewardship

We Pursue Engagement In Three Ways.

We are investors that push for change in corporate behavior.

Equally, we are also a company that wants to build our business practices to high standards.

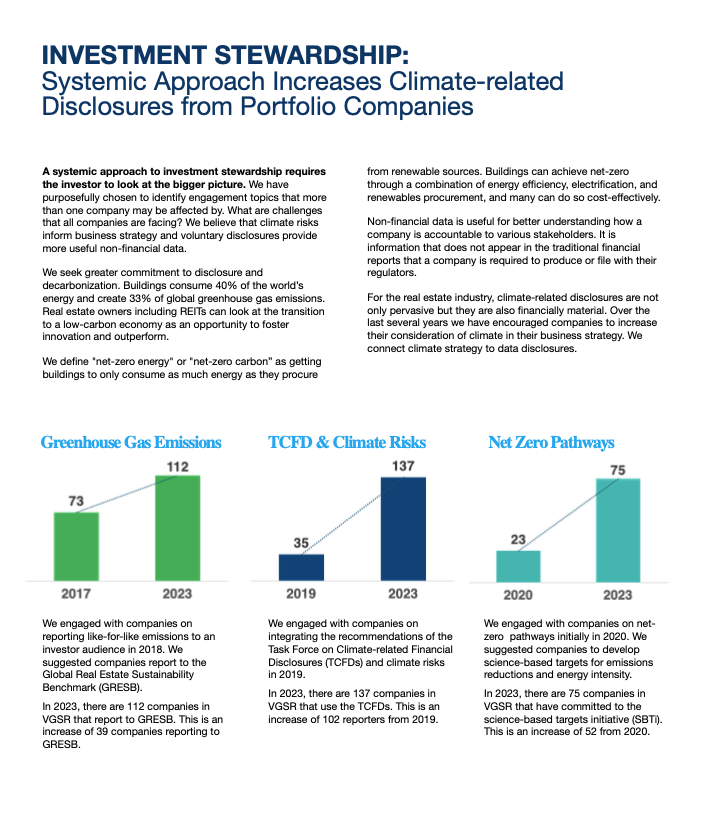

Vert’s shareholder engagement is multi-layer. We want companies to understand that taking care of the triple bottom line of people, planet, and profit, is a more successful way to run their business. We engage directly with the companies we hold, encouraging stronger sustainability practices that align with long-term value creation.

Beyond Vert’s own engagement, we also participate in selected campaigns with non-profits and policy groups to bring awareness to specific sustainability risks and opportunities.

Vert, as a shareholder, votes its proxies. Our proxy voting policy is aligned with our concern for good corporate governance, environmental stewardship, and social well-being. Our Proxy Voting Summary is publicly available on our fund website.

Vert participates in advocacy work to build capacity for environmental, social, and governance transparency in the financial services industry.

To facilitate this work, Vert is a member of The Forum for Sustainable and Responsible Investment (US SIF), a signatory to the Principles for Responsible Investing (PRI), supporters of the Task Force for Climate-Related Financial Disclosures (TCFD), and investor members of the Global Real Estate Sustainability Benchmark (GRESB).

Additionally, we coordinate with other various non-governmental organizations and asset managers on selected campaigns to represent the ‘sustainable investor voice’ to companies, networks, or government agencies on specific issues. Please review our Annual Impact Report for an example of the initiatives we’ve supported available on our fund website.

We believe sustainability isn’t a side initiative. It’s central to how a business should be run. That’s why we became a Certified B Corporation: to signal to our clients and partners that we’re serious about aligning our operations with the values we bring to our investment approach.

B Corp certification is a rigorous process led by the nonprofit B Lab. Think of it as the business world’s equivalent of LEED for buildings or USDA Organic for food, a trusted benchmark for companies committed to doing better for people and the planet.

For us, it’s about walking the talk. We want our clients to know that the same principles we apply to sustainable investing also guide how we manage our firm with transparency, accountability, and a long-term view.

Mapping ESG

A Landscape Review of Certifications, Reporting Frameworks and Practices

From 2021 to 2023, we worked with the Urban Land Institute (ULI) and other real estate investors on mapping the myriad of ESG frameworks. The report Mapping ESG: A Landscape Review of Certifications, Reporting Frameworks and Practices was released in April 2023.

The findings enable companies inundated with sustainability reporting requests better tell their story to external stakeholders.

- Describes 14 different reporting frameworks by profiling the ESG components each one.

- Categorizes reporting requirements for specific audiences from general sustainability reporting for broader multi-stakeholder focus to financial reporting for investors.

- Maps criteria to specific ESG categories so teams understand their composition, how they are similar or different, and identify overlaps.

- Reduces the reporting burden to re-focus on results.

Sustainability reporting has evolved quickly over the last 5 years more so than the twenty years prior. More reporting doesn’t necessarily mean clearer communication.

Engagement

2023 Annual ESG Report

Our sixth annual ESG report discusses our engagement program for the past year through investment stewardship, industry advocacy, and being a sustainable business.

Past reports are all found on the Vert Funds site.

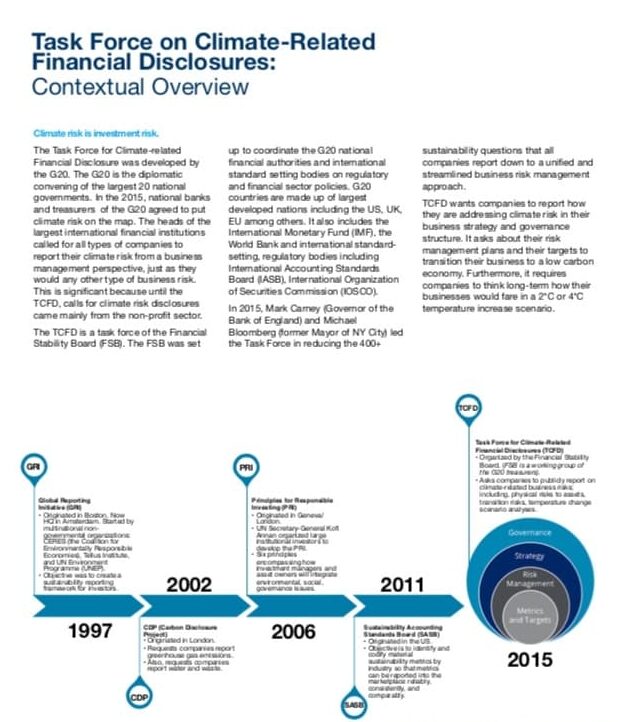

2022 Annual TCFD Report

We are supporters of the Task Force for Climate-Related Financial Disclosures (TCFD) – an international effort to normalize climate-related financial disclosures and make it common practices for companies. TCFD asks companies to report on governance, strategy, risk management, metrics and targets.

- 2018 – We formally endorsed the TCFDs.

- 2019 – We engaged our portfolio companies on the TCFDs.

- 2019 – We voluntarily reported TCFD responses in the PRI annual questionnaire.

- 2020 – We integrated the TCFDs into our annual impact report.

We publish this stand alone report to increase accessibility, transparency and to reinforce our belief in the efficacy of the framework.